Financial Advisor Mindset: A Practical Framework for Getting Results

Watch Those Words – Part 1

Have you ever wondered if there’s a secret to how the top 1% perform?

It’s really not as much a secret as a formula for getting results. I’ve used this simple formula for years to conjure a winning attitude for tough tasks and to persevere against the odds. And other financial advisors can tap into the same mindset algorithm to get results.

Is this just another formula?

Fair question. There are pages upon pages of books on mindset and performance. So, I welcome your skepticism. I’ll even bet that you’ve read most of those books (or at least more than I have). You may have even spent hard-earned cash to be coached by one of those performance coaches (that authored one of those books), so you probably feel you have it dialed in. Right?

I’m not doubting your pedigree, knowledge or experience … But if you’re like me, you probably still look at the top 1% and wonder, ”How do they do it?”

What creates momentum?

In a book called “Good to Great” by Jim Collins, there’s a metaphor of a flywheel. Think of a large wheel that requires several turns before it gains self-sustaining momentum. A snowball effect of sorts, if you will.

The flywheel illustrates what makes the top 1% as successful as they are. Are you ready?

The answer is Repetition.

The practice of doing something over and over again actually makes you quite good at something — especially when you do it the right way. Shooting free throws. Practicing musical scales. Cooking. Parenting. (Well, maybe parenting requires a bit more than just repetition).

In Malcolm Gladwell’s “Outliers”,the author argues that the road to a sweeping success of The Beatles in the United States was paved by countless nights of playing clubs in the UK.

In other words, they put in their 10,000 hours.

The first layer—financial advisor mindset. “Watch those words”

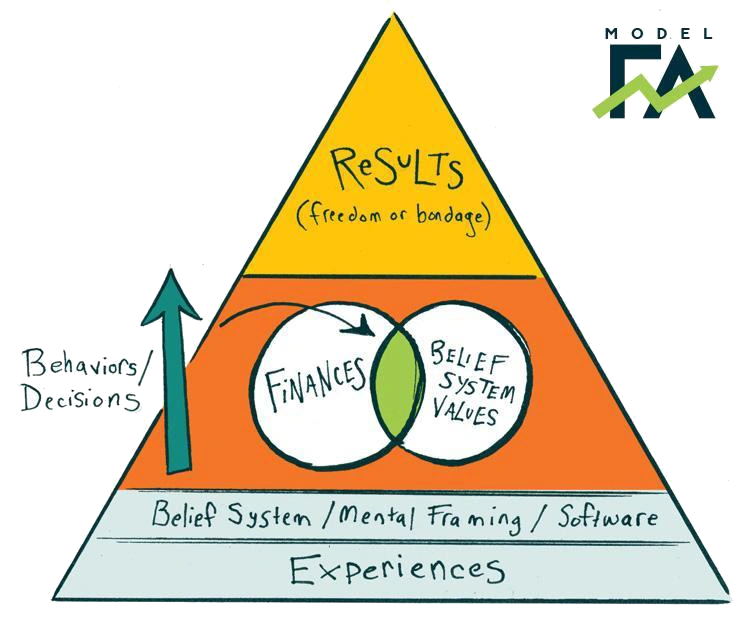

Let this graphic sink in for just a second. I want you to think about how the top of the pyramid is what most focus on — results. However, there are lots of steps before we get to results and it all starts with financial advisor mindset.

If you only take one thing away from reading this, it should be this. What you believe about something is critical to your success or failure.

Think about the last dream you had when you were falling. Do you remember that feeling? Your heart is racing. You may have even broken out into a cold sweat, even though you were only dreaming. Why is this? It’s because your brain can’t tell the difference between real life and a dream. And since that is the case, you can literally program your thoughts and belief system (“financial advisor mindset”) to affirm the reality that you want to exist.

You have seen phrases like this, right?

- This will be the most productive day of my life

- I will encounter someone today and have a life changing moment

- I have what it takes to make it to the next level of success

As corny as these “affirming” phrases might be, they are in heavy rotation in the talk tracks of the top 1%. The opposite is true, as well. If you pollute your thoughts with negative thoughts and beliefs, you are limiting your potential.

Have you ever caught yourself saying any of these?

- I can’t do this.

- I’m no good at that.

- There’s no way that can happen.

The power in any set of words is the degree to which we believe what is being said. And just in case you didn’t know it, you tend to believe what you say to yourself.

This article was originally published on ModelFA.com

Author Bio:

DOMINIQUE HENDERSON